After a storm, the role of an insurance adjuster is pivotal in determining the extent of property damage and whether repairs or replacements are covered under your insurance policy. Understanding their evaluation criteria helps property owners prepare for the inspection and ensure that all damages are adequately documented.

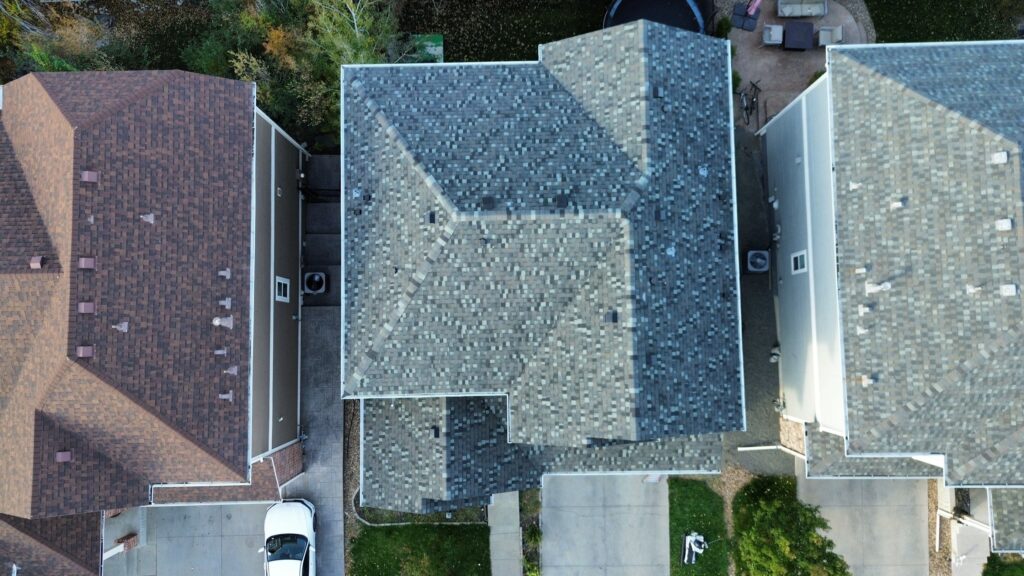

1. Assessing Roof Surface for Storm-Related Damage

The roof is the primary concern during post-storm inspections, as it bears the brunt of hail, wind, or snow. Adjusters examine:

- Granule Loss on Shingles: Excessive granule loss may not directly justify a roof replacement but signals potential compromise in its lifespan.

- Damaged or Missing Shingles: Ruptured matting from hail or broken shingles due to wind indicate functional compromise, often qualifying for repair or replacement.

- Condition of Roof Vents: Metal vent housings, also called box or turtle vents, are inspected for dents that provide evidence of hail impact.

2. Inspecting Gutters and Drainage Systems

Damaged gutters reveal essential clues about the storm’s severity. Adjusters evaluate:

- Signs of Impact Damage: Dents and distortions in gutters help document hail size and frequency.

- Functional Utility: Compromised gutters may no longer direct water effectively, risking further property damage.

3. Identifying Collateral Damage to Exterior Elements

Beyond the roof, adjusters inspect other exterior components to document comprehensive damage:

- Paint, Trim, and Fixtures: Chips, cracks, or peeling paint under eaves and other trim indicate possible water infiltration or wind damage.

- Windows and Screens: Cracks, shattered glass, or torn screens are assessed for repair needs.

- HVAC Units and Fencing: Visible dents or damage to air conditioning units and property boundaries signal high-impact events.

4. Checking for Interior Signs of Roof Leaks

Evidence of roof damage often manifests inside the property. Adjusters look for:

- Peeling Paint and Stains: Dark spots on ceilings or peeling paint under eaves may indicate water intrusion.

- Buckling Shingles or Roof Rot: These are symptoms of long-term exposure to moisture, worsened by storm conditions.

5. Establishing Hail Characteristics: Size, Frequency, and Directionality

Hail impact is meticulously documented for insurance purposes. Adjusters focus on:

- Impressions on Soft Metals: Indentations on vents and flashing help gauge hail size.

- Patterns on Roofing and Gutters: Directionality indicates the storm’s path and severity.

6. Evaluating Covered Perils Under Insurance Policies

Determining whether the damage qualifies as a covered peril is critical. Adjusters ensure that:

- Evidence Matches Policy Definitions: Damages like wind, hail, or snow are documented in alignment with policy criteria.

- Damage Is Isolated to Storm Events: Pre-existing issues or unrelated wear and tear are excluded from claims.

Why a Professional Inspection Matters

Partnering with experienced professionals like Tried and True Roofing ensures a meticulous assessment of storm damage. Our team in Denver, Colorado, specializes in providing thorough evaluations and assisting with insurance claims, offering peace of mind when you need it most.

Conclusion

After a storm, an insurance adjuster’s role is to meticulously document damages and provide a comprehensive report for the claims process. Property owners should prepare for inspections by understanding key evaluation points, ranging from roof conditions to interior leaks. For expert assistance, trust Tried and True Roofing, the premier roofing company in Denver, to safeguard your property and navigate the complexities of insurance claims efficiently.